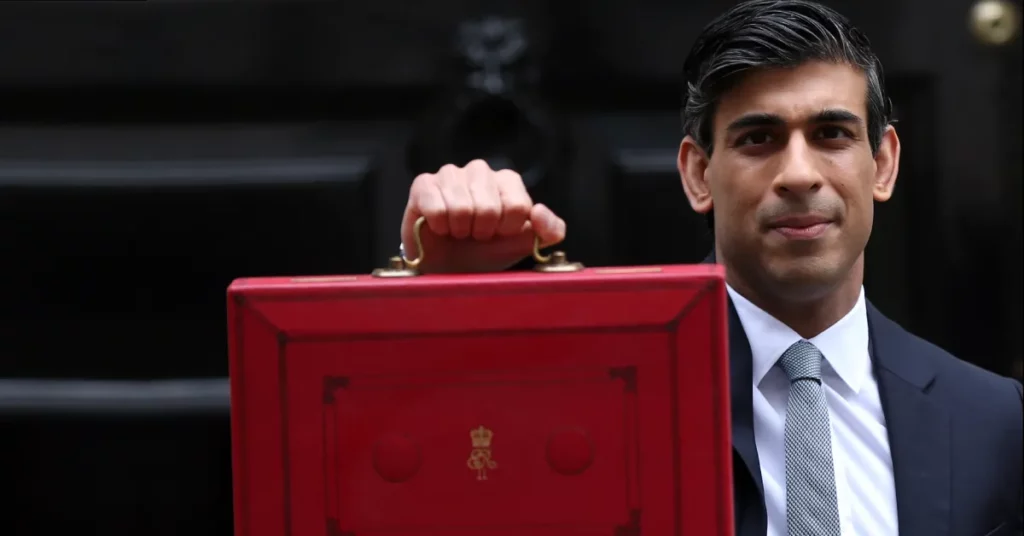

UK’s Autumn Budget 2021 will be declared by the Chancellor of the Exchequer, Rishi Sunak, this week. The Budget will elucidate the United Kingdom’s economic recuperation from the COVID19 pandemic.

There has been an outbreak of declarations building up to the Autumn Budget 2021, inclusive of an attractive rise in the United Kingdom’s minimum wage rates.

The Chancellor, Rishi Sunak, will express an expenditure review parallelly and has vouched to enhance growth whilst holding the public finances on a sustainable freeway.

The realization of the Autumn Budget 2021

In September 2021, the Chancellor of the Exchequer declared that he would reveal the Autumn Budget 2021 on 27th Oct 2021 (Wednesday). The endeavor usually succeeds the Prime Minister’s Questions and is estimated to begin at 12:30 pm.

The Autumn Budget 2021 is the second budget for this year after Mr. Sunak delivered the March 2021 United Kingdom Budget on 3rd March 2021. The previous address of the Autumn Budget was delayed owing to the COVID19 pandemic.

Alongside the Budget, the Chancellor will establish the UK government departments’ capital and resource budgets for 2022-2023 to 2024-2025.

What has been established in the Autumn Budget 2021 already?

Several headline measures encompassed in the Autumn Budget 2021 have been established before the announcement, with the surge in the UK’s minimum wage rates as one of the most attractive variations.

It has been long-established that the National Living Wage will rise to GBP 9.50 (USD 13.07) from April 2022. This surge parallels an excess of GBP 1,000 (USD 1376.20) annually for a full-time worker.

The surge in wages will also witness a surge in National Minimum Wage to GBP 9.18 (USD 12.63), whilst the Apprentice Rate surges to GBP 4.81 (USD 6.62) every hour.

Here’s a list of all the confirmed measures elucidated in the Autumn Budget 2021:

- GBP 7 billion (USD 9.63 billion) for regions outside London to uplift transport.

- GBP 5 billion (USD 6.88 billion) for health-centric research and improvement, inclusive of tackling health discrepancies and genome sequencing.

- GBP 3 billion (USD 4.13 billion) to steer a ‘skill revolution’.

- GBP 1.4 billion (USD 1.93 billion) to pipette money into chief innovative sectors and a new-fangled talent link to bring foreign talent into the industries of the United Kingdom.

- GBP 850 million (USD 1169.77 million) to rejuvenate cultural hotspots.

- GBP 700 million (USD 963.34 million) for a new patrol fleet for the borders of Britain.

- GBP 700 million (USD 963.34 million) to enhance youth and sports clubs.

- GBP 560 million (USD 770.67 million) to deliver customized math coaching.

- GBP 500 million (USD 688.10 million) to aid families and children (inclusive of new-fangled family hubs)

- GBP 435 million (USD 598.65 million) for crime retention and the Crown Prosecution Service, a fraction of which focuses on enhancing the retaliation towards rape and sexual assault cases.

- GBP 5 million (USD 6.88 million) for advanced treatments for veterans.

Other estimations associated with the Autumn Budget 2021

Whilst there are most certainly going to be a few surprises in Mr. Sunak’s speech on Wednesday, there are numerous other problems which are expected to be addressed on the agenda.

Salary Freeze – The Chancellor is broadly estimating to close a one-year freeze on the public-sector salary, presented to control the deficit when the economy was dwindling owing to the aftermaths of the COVID19 pandemic.

Student Loans – Mr. Sunak may reduce the threshold at which individuals start reimbursing their student loans, which could save approximately GBP 2 billion (USD 2.75 billion) annually.

Tax variations – Taxes are most likely not to be reduced in the Autumn Budget 2021, owing to the UK Government’s borrowings of GBP 299 billion (USD 411.48 billion) in the first year of the COVID19 pandemic. Mr. Sunak is expected to surge capital gains tax, which he initially froze until 2026 in the last Budget.