Turkish inflation rose since 2021 as the value of the Lira went down after the central bank’s policy rate slashing as per the measures taken by President Tayyip Erdogan to bring some relief to the soaring prices

Turkish inflation rose for the 17th straight month in October reaching 85.51% and marking a 24-year high, as energy and food prices continue to climb, according to official reports on Thursday, after the central bank slashes the policy rates amidst the surging prices. Turkish inflation rose since 2021 as the value of the Lira went down after the central bank’s policy rate slashing as per the measures taken by President Tayyip Erdogan to bring some relief to the soaring prices. The Turkish Lira sank the most in the month of May 2022 after the previous year, as the lira slipped against the dollar by as much as 1.5%.

This was mainly because of a sharp decline in Central Bank’s reserves and unusual monetary policies which left the currency exposed. Turkey’s interest rate also spiraled down earlier this year reaching the world’s lowest-about negative 56%. The central bank in the past three months cut down the policy rates by a total of 350 basis points to 10.5% from 12% along with the promise of cutting once again this month as a finishing move in the easing cycle, aiming to counter the global monetary policy tightening trend.

Turkey’s central bank raised the year-end forecast to 65.20% the previous week, making it the fourth upward revision this year. The economic programs by the government give importance to low rates which could boost production and exports with the intention of attaining account surplus.

Steaming Turkish economy

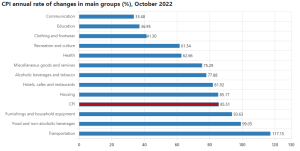

The Turkish Statistical Institute on Thursday reported that food prices were 99.05% higher than in the same period last year and transportation has increased by 117.15%. According to October 2022, the education sector with 0.36% was the group that indicated the lowest monthly rise while clothing and footwear with 8.34% was the important group where the highest monthly increase was reached. The furnishing and household equipment prices rose by 4.38%. On a month-on-month basis, the consumer price in the month of October 2022 raised 3.54% compared to the 2.39% and 2.13% in the same month in the years 2021 and 2020 respectively.

According to the Turkish Statistical Institute, the consumer price inflation was realized as 85.51% annually. The Domestic Producer Price Index showed an increase of 157.69% on annual basis and 7.83% on a monthly basis. The annual inflation in October has remained the highest since June 1998, when Turkey was working to bring an end to the decade-high inflation rates.

President Tayyip Erdogan refuses to increase the interest rate citing that it would harm the economy at a time when the living cost of around 80 million people continues to surge incessantly for the past two years along with the constant reduction in the value of the country’s currency. Lira’s 44% decline last year and 29% in this year mainly owes to the rising Turkish inflation rates. When currencies fall in value, the goods imported become more expensive. Most countries import goods, fuel, or technology, and when the currency is weaker, the prices become higher.

Many Turkish businesses have been affected by the fall in the value of currency which caused the cost of production to shoot up while the wages people receive folded to a great extent and the Gross Domestic Product (GDP) growth the country witnessed was too less.