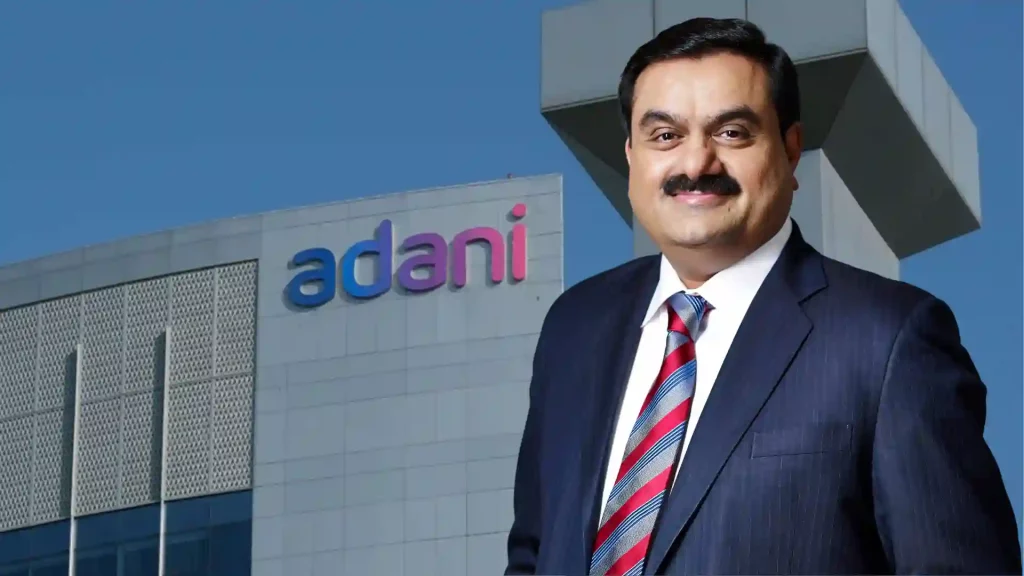

The owner of the Adani Group, Billionaire Gautam Adani’s attempt to restore the confidence of investors and shareholders seems to have less effect as the stock market losses intensify and dollar bonds drop to new lows.

Shares of Indian business company Adani Group tumbled on Monday despite the refutation of fraud claims by Hindenburg Research. The owner of the Adani Group, Billionaire Gautam Adani’s attempt to restore the confidence of investors and shareholders seems to have less effect as the stock market losses intensify and dollar bonds drop to new lows.

The three-day selloff has resulted in the erasure of $72 billion of market value in the middle of a share sale, that was meant to turn Adani into the center of the global business world. Adani group had rebuffed the allegations made by the Hindenburg Research ads as baseless and an attack against India, but the concerns regarding the company’s corporate governance still loom at large.

Additionally, it poses a risk of undermining public confidence in India, which was until recently one of Wall Street’s top investment destinations, and accelerating the transition toward a reopened China. In a long rebuttal published on Sunday, Adani stated that most of the questions raised by the Hindenburg research have been delivered in the company’s public disclosures explaining the seller’s act as “nothing short of a calculated securities fraud under applicable law.”

The group had also mentioned that it would exercise its rights to follow the remedies to safeguard the company’s stakeholders before all concerned authorities. Hindenburg on the other hand alleged the Adani group of ignoring the main accusations and was “obscured by nationalism”.

The conglomerate’s statement, according to the short seller, confused the company’s “meteoric ascent” and the wealth of Asia’s richest man “with the success of India itself” and failed to properly address 62 of Hindenburg’s 88 questions.

Adani’s had noteworthy earnings the last year and the company’s stocks were some of the best performers not just in the local market but also on the MSCI Asia Pacific Index.

Selling continued on Monday with Adani Total Gas Ltd. and Adani Transmission Ltd. down to 20%. His flagship Adani Enterprises also fell around 2%, erasing his previous 10% gain. Adani Enterprises shares remain below the floor price set for the subsequent sale. The company aims to raise 200 billion rupees ($2.5 billion).

Total subscriptions for Adani Enterprises‘ equity offering, which ends Tuesday, were down just 2% as of Thursday. A private investor bid for 3% of the shares offered, while the company’s employees bid for 10% of the shares in that category. The non-institutional portion, which includes wealthy individuals, was 1%. Institutional investors have bid on 4,576 shares, a small fraction of the 12.8 million on sale.

Investors typically wait until the final day of the sale to bid on her IPO in India, but there are growing concerns Hindenburg’s report could hurt sentiment. The fall in dollar-denominated bonds by Adani Group companies accelerated on Monday. Adani Ports & Special Economic Zone Ltd. 2027 notes fell 6.2 cents, according to data compiled by Bloomberg. At least four corporate bonds, including debt from Adani Electricity Mumbai Ltd., have fallen to bad debt levels below 70 cents against the dollar, broadly signaling growing credit concerns.