Ever since the introduction of generative AI tools, the Artificial Industry has garnered massive interest from all quarters. However, from a financial point of view, many industry enthusiasts are wondering whether Artificial Intelligence is the new Dot Com bubble in the making. The initial conditions in both cases seem somewhat similar. There’s huge interest; companies, even if they are just remotely concerned with Artificial Intelligence, are seeing their stocks surge, and every layman out there is talking about Artificial Intelligence as the next big innovation of the decade if not century. Whether this “big innovation” proves to be a bubble is what everyone is interested to see.

Why Is Everyone Wary of Artificial Intelligence Being The Next Bubble?

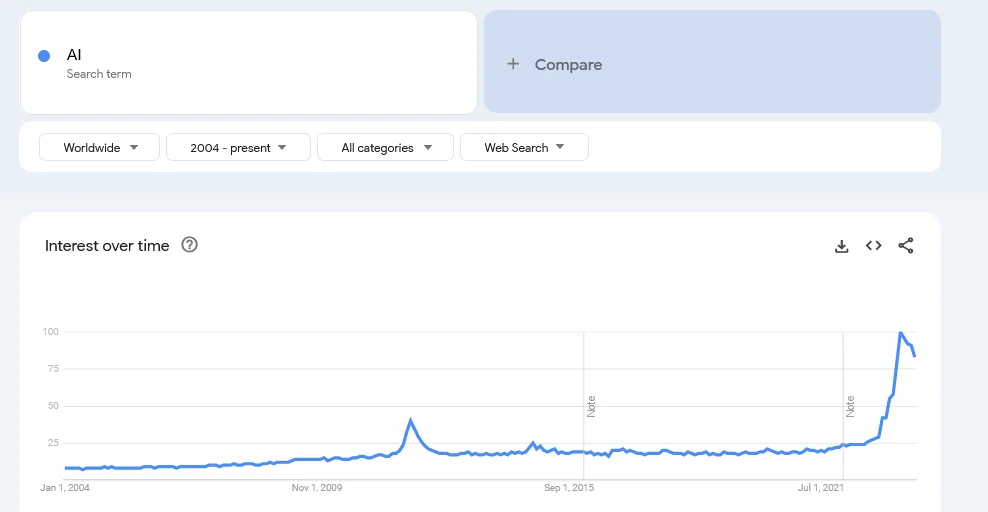

If one looks at the Google search trends, it becomes quite clear that the keyword “AI” is receiving abnormally high interest from all quarters.

Source: Google Trends

From the baseline of 20, the interest has peaked to the high of 92 units. Now, as you can see, instead of flatlining, the interest has started falling rather abruptly, which is concerning.

Now, coming to Artificial Intelligence stocks, legacy companies like Google (GOOG) or Microsoft (MSFT) are riding the Artificial Intelligence wave and seeing good results in terms of customer acquisition. Google, for example, reported a 15-fold increase in customers who use its Artificial Intelligence products and services – during the April-June period.

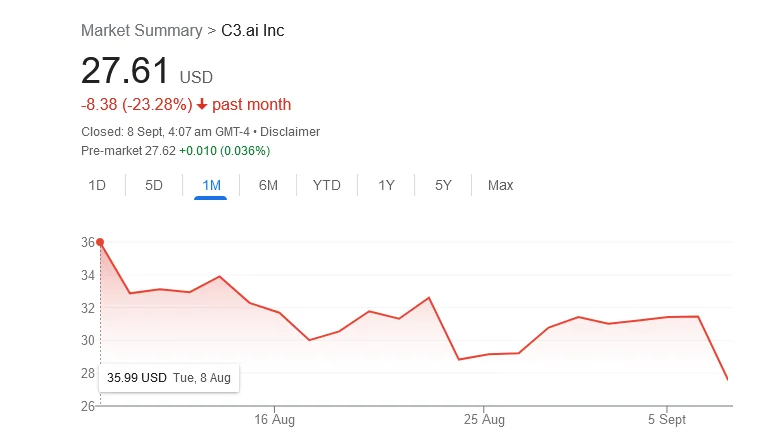

However, companies that rely primarily on Artificial Intelligence have started having a hard time in terms of revenue. The recent decline in the share price of C3.ai shows that the industry still needs some time to sustain itself independently.

Source: Google Finance

Furthermore, it has been reported in various quarters that OpenAI might go bankrupt in 2024. This proves that the interest in Artificial Intelligence is not backed by solid fundamentals but mostly by hype.

Goldman Sachs Remains Optimistic

Amid all the gloomy development in the Artificial Intelligence sector, the premier investment banking and investment management giant, Goldman Sachs, still remains optimistic about the growth of the Artificial Intelligence industry.

Goldman Sachs has given a solid reasoning behind its optimism. According to the group, the unprecedented growth of the Artificial Intelligence industry is quite different from the conditions seen during the Dot Com bubble.

Early Winners Are in a Good Position

According to Goldman Sachs, the early winners in the industry are in a financially stable position. These companies are recording impressive ROI.

The group has segregated profitable Artificial Intelligence companies into three groups – Enablers, HyperScalers, and Empowered Users.

Interestingly, companies in all these three groups are so-called legacy companies that were established at least more than a decade ago, if not more.

The comparatively newer companies are in the Enablers group. The youngest organisation to be listed in this group is Crowd Holdings Inc., which offers cloud-powered cyber threat prevention services. Another comparatively young company in the Enabler group is Marvell Technology Inc. – a semiconductor manufacturing company.

The well-established companies fall in the HyperScalers and Empowered Users group. Organisations like Google, Microsoft, Meta, Adobe, ServiceNow, etc., are in these two groups.

Bottomline: Established Companies That Are Adopting AI Are the Winners. The AI-dependent companies Aren’t in the Game

As one can see from the analysis presented by Goldman Sachs, it’s the well-established legacy technology companies that are making the most out of the rising interest in Artificial Intelligence. They are the ones that are making money from Artificial Intelligence. Apart from them, the enablers – the manufacturers of infrastructure used by Artificial Intelligence tools and services (mostly semiconductors) are in a good position as well.

However, companies that deal primarily with Artificial Intelligence-related products and services are still not profitable. Only time will tell if Artificial Intelligence-dependent companies like OpenAI or C3.ai can ever build a self-sustaining business or not. However, Artificial Intelligence – as an industry – isn’t going to see a decline in interest or money anytime soon.