The EU has proposed a similar tariff-rate quota with a specific number of imported automobiles, but according to two US sources, the Trump administration was leaning against it.

Brussels is attempting to negotiate with the United States (US) regarding import quotas, tariff cuts, and credits against the value of EU automakers’ US exports, to protect the European Union (EU) auto industry from high import tariffs.

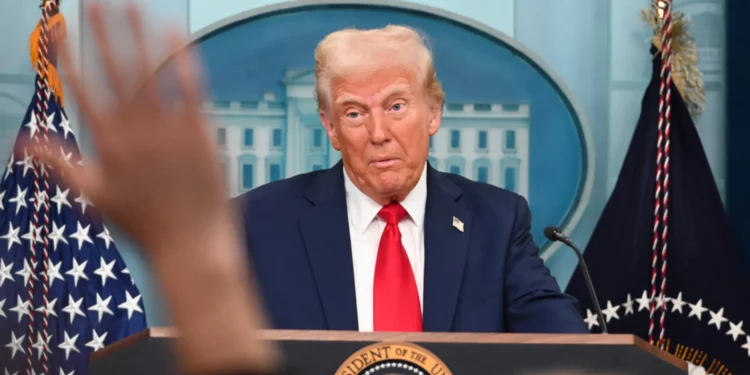

The European Union is trying to come to a trade agreement with the United States before the August 1 deadline set by US President Donald Trump for significant tariff rises.

Trump stated that he would likely inform the EU within two days about the rate it can expect for its exports to the US.

EU negotiators have requested relief from tariffs for key industries, including cars and aerospace. Since April, EU automakers have been subject to 25% tariffs in addition to the 2.5% tariffs.

Sources claim that negotiations are still going, and it is uncertain whether the US would accept all demands from its largest bilateral trading partner.

The White House, the US trade representatives, or the Commerce Department did not respond to requests for comments. Additionally, the European Commission did not respond to this news.

The sources, which include two from European industry, three European representatives, and three industry representatives, declined to be identified due to the nature of the sensitive topic.

The EU Trade Director stated that the Commission has made progress on the trade agreement with the US and will reach a deal within the next few days.

According to one European officer and a United States source, the discussions are going very “fast.”

According to three sources, a plan is on the table that would provide some relief from import tariffs for automakers producing cars in the US and selling them to other countries.

Under that plan, automakers that export vehicles from the US would get credits for that export value. It would be deducted later from the cost of EU imports into the United States.

Such a system would benefit carmakers like Mercedes-Benz and BMW, which have sizable production facilities in the US for sports utility vehicle production, with a significant share of exports.

Volkswagen, which hardly exports from US factories, is considering local production for Audi. It will benefit from some relief if the company agrees to invest more in the US.

Companies can import cars for a limited duty-free or discounted rate, but anything over that would be subject to high tariffs.

Brussels must strike a delicate balance while negotiating terms as it tries to find a concession acceptable to automakers like Mercedes-Benz, Porsche, Volkswagen, and BMW, as well as the Trump administration, which wants to increase US manufacturing and create jobs.

European Auto Association (ACEA) data reports that Europe shipped 758,000 cars to the US in 2024, worth 38.9 billion euros ($45.57 billion), four times more than the opposite direction.

Two sources state that the framework was similar to one agreed with Britain in May. The US reduced tariffs on British-made cars to 10% and British automakers got a quota of 100,000 cars annually at a lower tariff rate.

The EU has proposed a similar tariff-rate quota with a specific number of imported automobiles, but according to two US sources, the Trump administration was leaning against it.

According to three sources, both sides have talked about reducing their current auto import taxes, which are 10% for imports into the EU and 27.5% for imports into the US.

One of the sources stated that the EU is also offering non-tariff elements, including standardising regulations on auto safety testing.