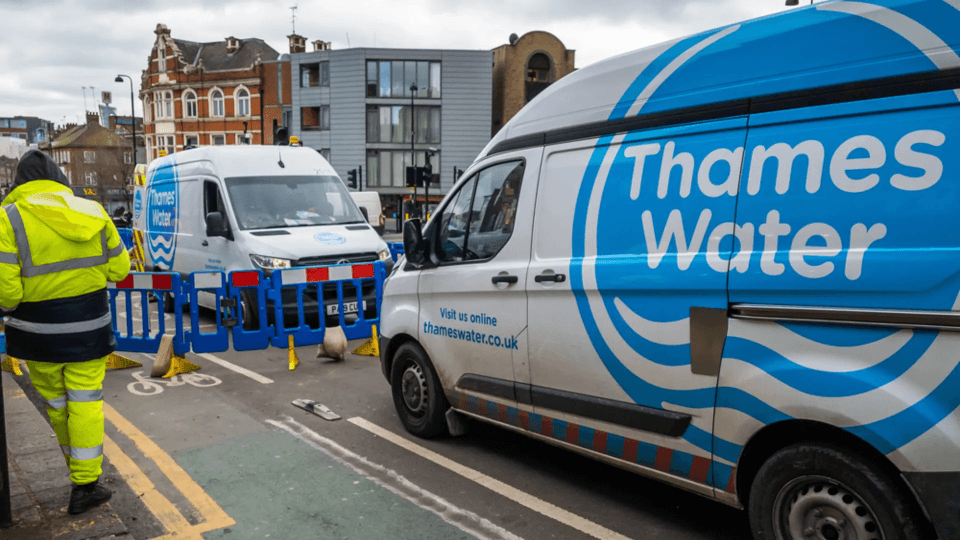

Thames Water, which serves around 16 million people in London and the southeast of England, is racing to build a plan to avoid financial failure.

A Hong Kong-based infrastructure company is reportedly the top candidate to buy Thames Water if the heavily indebted company collapses in the coming weeks.

CK Infrastructure Holdings (CKI), which invests in UK power and utility companies, is also part of the list that wants to buy a water and sewerage supplier if it falls into a special administration regime (SAR). SAR is a procedure that allows a company critical to the public interest, such as a water supplier or investment bank, to face insolvency, enabling the government to take over its operations to maintain essential services.

CKI has reportedly been willing to accept stricter environmental penalties than Thames’s class A creditors, who have their own acquisition bid.

The group of creditors has asserted that the company cannot afford to operate with £1 billion in fines, imposed by the regulators for breaches such as illegally dumping sewage. In May, Thames Water received a fine of £104 million for environmental breaches related to sewage spills.

In recent months, the Environment Secretary, Steve Reed, has taken steps to put the company into SAR, effectively a temporary form of nationalisation.

The government confirmed the appointment of FTI Consulting to develop contingency plans in the event of a collapse. FTI was the first choice to be an administrator if the government opts for SAR.

Advocacy groups want Reed not to sell Thames Water immediately after an SAR, instead proposing that it be considered for nationalisation.

River Action, an organisation on a mission to rescue Britain’s rivers from toxic sewage and industrial waste, cautioned that writing off the company’s debts and handing it to another private company would be a severe betrayal of the public.

Amy Fairman, the group’s head of campaigns, stated that the crisis will help the company to build goodwill among people, rather than private gain. Labour campaigned to tackle the water crisis and help underperforming water companies; this opportunity will help create a new path, rather than making the mistake of selling to foreign buyers for a quick deal.

Thames, which serves around 16 million people in London and the southeast of England, is racing to build a plan to avoid financial failure.

Earlier this year, Thames faced embarrassment when its preferred bidder, KKR, unexpectedly withdrew from the deal. Its Class A creditors, who hold the majority of its senior debt, are in talks with the regulators of England and Wales, Ofwat, to inject capital into the company, which carries net debts of £17.7 billion.

CKI has previously expressed interest in buying the company and contacted Sir Adrian Montague, the chair of Thames, after KKR backed out earlier this summer.

The private infrastructure giant was removed earlier from the bidding process, despite submitting a multibillion-pound offer, as Thames selected KKR as its preferred bidder and started negotiating with the company.

Ministers have reassured that CKI has extensive experience in managing large-scale assets, such as UK Power Networks, although some MPs have expressed concerns about its connection with Beijing. The Chinese government’s sovereign wealth fund holds 9% shares in Thames Water.

The former Conservative leader, Iain Duncan Smith, previously stated that the CKI acquisition of Thames Water should be avoided at all costs.

A spokesperson for Thames Water stated that their priority is on a holistic and fundamental recapitalisation, aimed at achieving a solution that helps the market target investment-grade credit ratings and stabilising the company’s financial base. They are engaging in ongoing positive discussions with numerous stakeholders.

CKI was contacted for a response, but they have not given one yet.