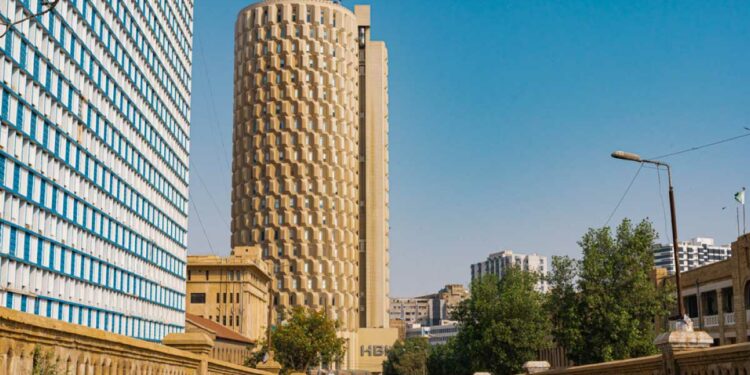

Pakistan Mortgage Refinance Company (PMRC) issued a second privately-placed Sukuk of Rs1 billion to promote housing finance. The incorporation of the firm is to provide long-term finance, thereby is a mortgage liquidity facility. The firm announced the Sukuk issue with the collaboration of HBL Islamic Banking.

The issue will act as an accessible sharia-compliant housing finance facility helping the public to fulfill their needs.

There has been an increase in the housing prices in Pakistan of nearly 40% from 1972 to 2018. The growth has directly affected buying as most of the population falls in the middle and low-income groups. The GDP of Pakistan is $296 billion as of 2021, which the government has set a 4.8% growth target to achieve in the next financial year. In contrast, the IMF and World Bank estimates are nearly half the expectations.

PMRC offers refinancing and capital investments with crucial advantages like:

- AAA Rated Entity for long term

- Collateral is based on Top Tier Financial Institutions Receivables Portfolio

- Fixed-rate, long tenure loans up to 3 and 5 years

- Stable source of income or returns for entire tenor the interest rate is locked at the beginning

PMRC provides conventional bonds and Sukuk that help its Partner Financial Institutions (PFIs) in availing long-term financing. The mortgage buyers of the PFIs can benefit from the fixed-rate policy without fluctuations. The provision to the partners and public of TFCs & Sukuks helps the firm to optimize its cost.

The Sukuk offers will lead to business growth and stability in the bond market. A well-structured business model, noteworthy balance sheet, and stable shareholders serve as the significant strengths of PMRC, which it would capitalize on to be a strong investor.

The finance bill 2021-22, the CGT on immovable property is flat five percent up to the capital gain amounting to Rs5m, which is not convincing the realtors.

The real estate scenario in Pakistan has been damp in the last year due to the pandemic, which reduced the investments due to lack of demand. Yet, the projection in the next year is quite profitable with improved investments and an increase in demand. Few projects like Blue World City Islamabad, Capital Smart City Islamabad, Park View City Islamabad, and Lahore Smart City pave the way for investments.