Pag Bank has been hugely accepted by the people of Brazil, with 10% of all Pix transactions taking place via Pag Bank.

A jump of 87% in revenue, a 163% increase in deposits, and an impressive credit portfolio of R$ 2.3 Billion – that’s what the Q2 of Brazil’s Pag Bank looks like. Yet hardly any people outside of the country have heard of this bank. Even in Brazil, the bank has been away from the limelight. It has been growing quietly, and now, it is the second-largest digital bank as far as the number of clients is concerned.

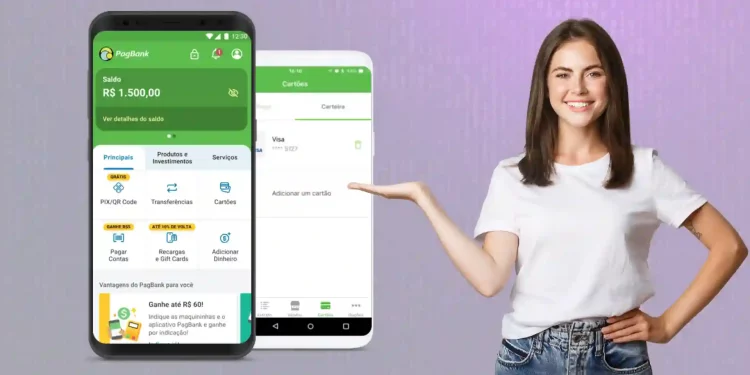

With such impressive revenues, the bank’s cost and revenue are close to being equal. Despite being under the shadows, Pag Bank has been hugely accepted by the people of Brazil, with 10% of all Pix transactions taking place via Pag Bank. The bank has been rolling out new products and services consistently, resulting in greater customer engagement.

This Brazilian bank has been cautious about expanding its credit portfolio. More than 90% of its underwriting in this quarter was in the form of secured loans. The bank launched its collateral-based secured credit in July this year, further boosting its credit portfolio without exposing itself to increased risk.

Pag Bank took this risk-averse stance as far as its credit portfolio is concerned because just when it started offering credit services, the pandemic hit the world, which affected the Brazilian economy badly. The bank’s leadership realized that giving out unsecured loans might not be the best idea in these economically challenging times. Hence, the bank leveraged secured credit cards and secured loans like Payroll loans, etc., to expand its credit portfolio in a risk-free way.

Impressive Increase In Clients

As of Q2, Pag Bank boasts 24.8 million clients – a 41% increase compared to the same quarter of the previous year. The bank also saw a 35% increase in active customers. This figure stands at 15.1 million as of Q2. The ease of use and increased penetration by the bank are the two primary reasons behind this impressive performance.

A Bank For The Masses

PagSeguro, the parent company of Pag Bank, is known for its wide reach among the masses. As part of UOL – the fifth most visited website in Brazil, Pagseguro and, thus, the bank enjoy close proximity with a wide cross-section of the society. Financial inclusion of the masses has been the key to PagBank’s growth. It helped people from the low-income segment take benefit of formal banking services.

With Brazil’s homegrown Pix payment system, Pag Bank has made the banking process for first-time users as painless as possible. This is why Pag Bank accounts for 70% of the first-time accounts opened by ordinary Brazilians.

Since the parent company PagSeguro, has an already popular digital payment ecosystem, it has started bringing Pag Bank and Pagseguro closer in order to leverage its association with the country’s millions of retailers, small business owners and freelancers. This has further boosted the growth of the bank as now the money received by these business owners goes to their Pag Bank account.

The Leadership

Pag Bank boasts of an able leadership steering from one milestone to another. Till October 2022, Alexandre Magnani and Ricardo Dutra helmed the fintech company and the bank. Now, Alexandre is the sole chief executive of both Pag Seguro and Pag Bank. With his extensive experience, spanning almost three decades, and his seven-year association with PAGS, Magnani is the right choice for the bank’s chief executive officer.